For those thinking about getting Berjaya Sompo car insurance, you can first start by knowing the most fundamental part of this insurance. Especially if you’re not used to reading about insurance, this is true.

Berjaya Sompo is a costly insurance company. Especially when we talk about investing abroad, it has become one of the most popular in 200 cities and 30 countries from Europe, North & South America, and Asia.

This insurance company offers an excellent option for people who want to save money on their car insurance. The comprehensive coverage available will cost more, but Berjaya Sompo also guarantees that you will get the benefits you need and peace of mind.

You know that with Berjaya Sompo, you are fully protected. In case anything happens along with other drivers or third parties where the accident takes place, Berjaya Sompo will immediately help. However, of course, you cannot register at random.

Also Read : Cheapest Car Insurance in California

Basic of Berjaya Sompo Car Insurance

This means you need to know more about Berjaya Sompo before using their services. It’s always a good idea to get yourself into by comparing the benefits and prices of different plans, and you won’t be affected by financial loss and legal trouble.

Additionally, protection is highly recommended because this is the main essence when you visit the Berjaya Sompo Insurance Berhad Malaysia office and ask for a registration form. It’s even better to start by knowing the following:

1. Features

We start first by discussing the features of this company. The cover type is comprehensive, with a 0% repair cost for vehicles aged five years and below. There is also E-hailing, which guarantees that the entire insurance claim process can be done online.

2. Coverage

Talking about Berjaya Sompo car insurance, the client wants to know what coverage is provided. All protection is provided from bodily injury, loss or damage, legal costs, and accidental death. But there is other add-on coverage.

3. Claims

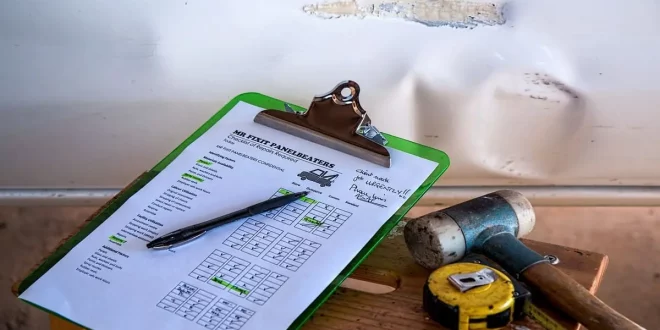

The claim process for an insurance company should be arranged, so the client is satisfied. But don’t worry, Berjaya Sompo has become a professional insurance company by providing a special hotline for Roadside Assistance, Claim Assistance.

Also Read : What Is Excess on Car Insurance ?

4. Comprehensive Protection

This is a comprehensive type of insurance company related to the Berjaya Sompo insurance claim; it will protect you and your finances because of whatever happens to your car. In addition, all of these processes are also very strict, so there are no difficulties.

5. The Benefits and How are My Premium Payments Determined?

You also, of course, want to know more about the insurance benefits and also the options available. You can also claim vehicle accessories with the current year no claim discount. At the same time, the cost will be determined by the engine size and other factors.

It is vital for those of you who ask whether or not it is necessary to pay insurance. You need to find the most appropriate and get the protection you need. Our advice is to choose Berjaya Sompo car insurance for maximum protection. (SA)

Also Read : Etiqa Car Insurance Renewal

Imaxshift.com : Insurance, Finance, Technology & Gadget Blog

Imaxshift.com : Insurance, Finance, Technology & Gadget Blog